June 10th marked the 58th anniversary of the Equal Pay Act, which made it illegal for employers to pay women less than men for substantially equal work. Still, as House Speaker Nancy Pelosi recently remarked in commemorating the anniversary, although the nation has made progress, “equal pay is not yet a reality.”

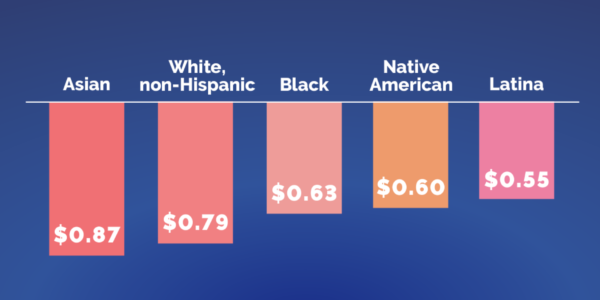

Indeed, women in the U.S. are paid only 82 cents to every dollar paid to men. According to the National Women’s Law Center, this number stood at 59 cents in 1963, when the Equal Pay Act was signed into law. The statistics are even starker for women of color: Black, native, and Latina women respectively make 63, 60, and 55 cents as compared to men.

The brunt of caregiving and family duties that fell on women during the COVID-19 pandemic (and their attendant retreat from the workforce) further underscores and exacerbates gender and race inequities in the workplace. The Department of Labor estimates that the pandemic set women’s labor force participation back to lows not seen in over 30 years.

Momentum is Building for Pay Equity Reforms

Although recent legislative efforts to strengthen equal pay protections have stalled in Congress, pressure for pay equity reforms continues to mount at both the state and federal levels. In particular, federal legislative reforms have sought to narrow a key affirmative defense available to employers who are found to have pay differentials between men and women. This defense gives employers an out if they can show that the pay differential is “based on any other factor other than sex.” Proposed reforms would require employers relying on the defense to show that the underlying reason for the pay differential: (1) is not based a sex-based reason; (2) is consistent with a business necessity related to the job; and (3) is the entire reason for the compensation differential. Proposed reforms would also prohibit the disclosure and use of wage and salary history in setting pay.

In addition, nearly every state (but Mississippi) has also enacted its own equal pay and pay transparency protections. Some, such as California’s, mirror proposed federal reforms that strengthen the burden of proof on employers to show a business necessity for pay differentials and prohibit the use of wage history in setting pay. The Department of Labor lists each state’s specific requirements here.

Component 2 Reporting Likely to Resume

Importantly, President Biden’s appointment of Jenny Yang as OFCCP director also signals a likely stronger focus on pay equity. Yang, a former chair of the Equal Employment Opportunity Commissions (EEOC) is a noted advocate for pay equity reforms. In particular, Yang was a proponent of the EEO-1 Component 2 reporting requirement that requires employers with over 100 employees to report pay information broken down by job category, sex, ethnicity, and race. Component 2 reporting was initially implemented under the Obama administration but was discontinued by the EEOC in 2019. It is anticipated Component 2 reporting (in some form) will likely be renewed under Yang’s direction.

How Federal Contractors Can Prepare for Changes to Pay Equity Reporting Requirements

1. Evaluate current policies and procedures.

Some policies and practices that seem harmless may inadvertently lead to unlawful pay disparities. Promotion decisions, performance ratings, the availability of training opportunities, leave policies, implicitly steering applicants into lower-paying jobs, and limiting transfers to better-compensated jobs can all lead to systematic pay disparities. Employers should evaluate all of these factors and adjust policies and procedures accordingly. In addition, employers should also look beyond base pay rates in analyzing compensation differences. Bonuses, overtime, and other benefits or incentives are all relevant in determining compensation.

2. Regularly audit pay practices to identify unlawful pay disparities.

Having an effective self-monitoring system in place can help employees avoid inadvertent equal pay infractions. Federal contractors should conduct regular pay equity audits that analyze similarly situated groups of employees for statistical differences that can’t be explained by non-sex-based factors. If statistical differences are found and cannot be explained, employers should take steps to remedy the differences and adjust salaries accordingly.

3. Talk to compliance professionals and counsel early.

The best time to address pay disparity and other potential problem areas is before you receive a notice of compliance audit. In particular, employers should work proactively to ensure that proper records and documentation are maintained and preserved to respond appropriately to OFCCP inquiries, including the potential reinstatement of Component 2 reporting requirements. An OFCCP compliance expert can help you identify and address recordkeeping and compliance weaknesses and navigate the path ahead.

If you need help with your AAP compliance efforts, HR Unlimited Inc. can help! Our comprehensive affirmative action services assist you in all phases of affirmative action compliance. Contact us today to learn more about the many benefits of our Affirmative Action Partnership!